Fundbox offers business owners a cash-in-hand solution better than unsecured small business loans or standard invoice factoring

Peter hurried Julia off the phone. Things between them were going great and he did not want to expose her to his darkening mood. He was excited to be dating such a beautiful and intelligent woman, but how was she going to react to him having to cancel the trip they had planned for next week – their very first trip together? Worst, how was she going to react to the news that he was broke?

How could this happen!? He had a successful architecture firm and had even just opened a second office. But that was part of his cash flow problem: some of his big, A-list clients weren’t the best when it came to closing projects or quickly paying invoices, and opening that new office had cost real money. Truth was, Peter had bills due and no money to pay them. He had profits on paper, but no cash… he was broke.

Revenue and Receivables are NOT Cash

Managing cash flow may be THE MOST important factor affecting the success of small and mid-size businesses. Even a profitable business can go bankrupt if they run out of cash. In fact, over 80 percent of business failures in the U.S. are due to poor cash management.

In most cases, you deliver goods and services to clients along with an invoice which they pay sometime later. Standard invoicing periods are often 30, 60, or 90 days. In some situations, like a distributor selling goods to retailers, you might not get paid on those invoices for four to six months.

Invoicing the customer creates revenue, but you have to actually collect the money to create cash. And you need a steady supply of cash to pay salaries, buy equipment, travel, and meet all of your other day-to-day business expenses.

Ideally, to protect your business from cash flow issues, you should maintain an account balance equivalent to a minimum of two months of operating expenses. This buffer allows you to keep doing business and generating revenue in the event of unexpected stalls to your cash flow. But maintaining this operating fund is not always possible, and two months isn’t always enough.

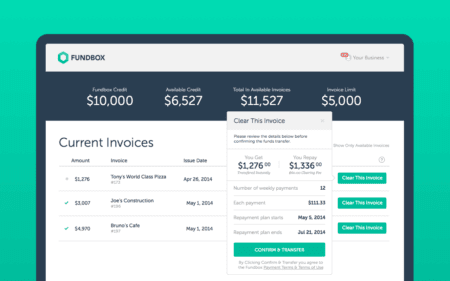

Fundbox Instantly Advances Payments on Outstanding Invoices

Fundbox is a great service we recently discovered offering a common-sense approach to cash flow management. You submit unpaid invoices and they advance you 100% of the amount owed. You then pay back the advance plus a small clearing fee (approx. 0.5%) over 12 weeks. The entire process is automated and you can pay off the advance early and avoid the remainder of the clearing fee. It’s free to open an account with them and you can step in and out whenever you want. There’s no application process, no obligation of any kind, and you pay nothing until you use the service.

I looked over their whole operation and they are the real deal – a simple, straightforward idea, well thought out and expertly executed. They have no hidden fees, no small print, and no back door sales tactics. They are what they appear to be: a great, affordable resource for business owners to take better control of their accounts receivable and their business financing.

Imagine how differently you could run your business if all of your invoices were paid as soon as they were issued? That is what Fundbox is offering. There is absolutely no cost to create a Fundbox account, just enter a bit of information and connect your accounting solution. In 30 seconds you are ready to take control of your cash-flow. Instead of waiting for 30, 60 or 90+ days to get paid, click any of your outstanding invoices to get the full amount transferred to your bank account instantly and securely.

Fundbox is an alternative to Unsecured Small Business, Invoice Financing, and ‘Quick’ Commercial Loans

Unsecured business loans and ‘quick’ commercial loans can be notoriously hard to get, often have unreasonable terms, and can take months to process. A bad choice or wrong decision and your business could be in even worst shape after finding one of these so-called cash flow ‘solutions.’

Other ways of getting outstanding invoices funded can get expensive. Invoice or receivables financing companies purchase uncollected invoices at a fraction of their value. Often paying only 80 or 85 cents on the dollar. Plus, they aggressively collect on those invoices once they own them, so this is not necessarily a good choice if you plan to keep working with the client or customer.

Giving customers a discount for paying invoices quickly is one method to keep cash flowing recommended by business experts. But they often suggest offers like a 10%+ discount for paying within 10 days. This approach is still no guarantee, takes a significant bite of your revenue, and lowers the perceived value of your goods or services.

Fundbox charges no interest and you get 100% of the value of the invoice; they make their money by charging a small fee for each week you have an outstanding balance (equal to approximately 0.5% of the invoice value). Starting the Wednesday after you have had the funds for 1 week, Fundbox automatically debits 1/12th of the invoice plus 1/12th of the clearing fee every week for 12 weeks. If you pay off the invoice advance early, the remainder of the cleaning fee is waived.

For example, the fees vary slightly depending on the invoice, but Fundbox says that on a $1,000 invoice they charge $60 in fees over the 12 week repayment period – this equates to $5 per week. If you paid off that advance after 2 weeks, you would only have paid $10 and the remaining $50 in clearing fees are waived.

You see the funding fee and repayment details before you clear each invoice, so you always know how much you will pay. When you clear an invoice, they deposit the money in your bank account via Automated Clearing House (ACH) in as little as 24 hours.

Whether you think you might use Fundbox once in a while to clear open invoices or make it part of your business process for managing your accounts receivable, set up a free account and take this service for a spin – you might find it’s a real game changer. In fact, they are inviting Idea180 Blog readers to try them out by offering to advance your first $1,000 for FREE. Use this link for the special offer: Sign Up For Fundbox